Home » CARM – CBSA Assessment And Revenue Management

What is CARM?

The CBSA Assessment and Revenue Management project is a multi-year initiative transforming the collection of duties and taxes for goods imported into Canada. CARM will modernize and streamline the process of importing commercial goods. This will allow the CBSA to strengthen audit controls, increase risk management, and ensure the higher compliance of Canadian importers against the various import rules and regulations.

Once fully implemented, CARM will provide importers with up-to-date access to their trade information and account balances, direct payment solutions, and various trade tools that can help simplify the importing process.

Important To Note

Importing into Canada is done both commercially and non-commercially – CARM impacts commercial importations*.

* Commercial importations consist of goods for any industrial, occupational, commercial, institutional, or other similar use in the workplace.

* Non-commercial importations relate to goods imported for personal use at home.

How Will CARM Impact Importers To Canada?

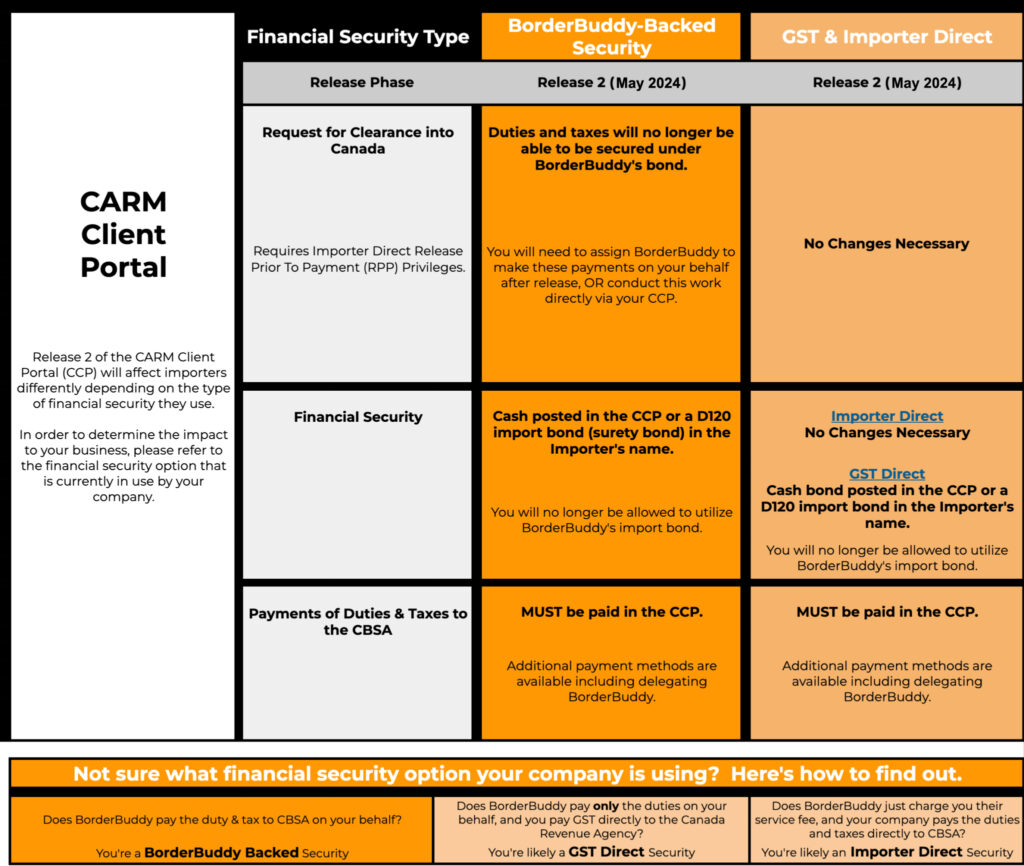

As a commercial importer to Canada – CARM will help streamline your import process more efficiently and allow the government of Canada to collect associated revenue. Commercial importers to Canada will no longer be able to use BorderBuddy’s financial security and must obtain their own by the implementation of R2 (Release 2).

CARM will help ensure that you are fully compliant with the import rules and regulations while paying the appropriate customs duties and taxes. It will also enable you to track your import activity, make payments, and reconcile any trade reports in a more standardized manner.

Do I Have to Participate? I Only Import A Few Items Per Year!

Yes. All commercial importers regardless of their geographic location, or how often they import to Canada are required to take part in the CARM initiative. Every importer to Canada will be required to register and access the CARM Client Portal (CCP) for eligibility to import goods commercially.

Registration must be completed before R2, which has a targeted release for May 2024.

CARM Client Portal – What Is It?

The CARM Client Portal (most often referred to as the CCP, or simply “the portal”) is a secure way to transact with the CBSA. Importers will be able to view their Statement of Account (SOA) with financial transactions, make credit card or pre-authorized payments, and submit rulings and appeals requests.

CARM is occurring in a phased approach:

Release 1 (Active as of May 25, 2021) the CCP will only provide importers with visuals of their import entry numbers, and any amounts owing.

- Importers are required to sign up and register their businesses on the CCP prior to R2.

Release 2 (Targeted release in May 2024) will expand the functionalities of the CARM Client Portal by adding:

- The introduction of electronic Commercial Accounting Declarations (CADs) with the ability for corrections and adjustments

- New requirements related to the Release Prior to Payment (RPP) program.

- Harmonized billing cycles (one due date as opposed to numerous dates based on the transaction)

- New offsetting options (the way credits are applied to your accounts)

- Electronic management of appeals and compliance actions

Do I Have To Do This Right Now? What Do I Need To Do?

Yes, you will need to be registered in the CARM Client Portal (CCP) before R2!

Not being registered in the CCP as of R2 will impact your ability to import goods into Canada. Being registered will also afford you enough time to resolve any issues that may come up during the registration process, allow you to familiarize yourself with the basic functions and activities currently in the CCP, confirm delegations, and ensure any account balances that could potentially interfere with acquiring your R2 financial security, are reconciled.

Before You Being Registering, Please Keep The Following in Mind:

First, ensure your legal entity information is accurately on file with the CBSA. You can verify by reviewing any recent correspondence from the CBSA or against your business account with the Canada Revenue Agency. Keep in mind that the legal name, address and contact information should be current and will need to exactly match what the CBSA has in their system including any punctuation or abbreviations.

Second, internally determine who will be responsible for registering and delegating access(es) in the CCP. This is referred to as the BAM (Business Account Manager), and this individual does not have to be an officer of the company and should be assigned to the individual that manages any trade information and/or who is responsible for payments to the CBSA.

Please also keep in mind that the first individual to link their account to the business in the CCP will automatically become the BAM, and will have to approve other users to the account after the business registration is complete.

The CBSA recommends establishing two (2) BAMs for your organization in the CCP.

The Individual Registering The Business On The CCP Will Need To Enter Pertinent Information Which Also Includes:

The BN9 of the company (This is the unique business number issued by the Canada Revenue Agency)

The import/export program account (RM extension)

Registered name and address associated with the business number (inclusive of any punctuation or abbreviations).

You should also review the CBSA’s CCP Registration Checklist to begin gathering the required information and begin the process of registering. BorderBuddy is standing by to help provide existing clients with the appropriate financial information if required, to help validate your account ahead of time!

Helpful Tools

The CBSA has also provided Onboarding Documentation and a playlist of videos offering step-by-step instructions for various CCP functions.

What Do You Mean By “Delegation?”

CARM is essentially shifting more responsibility onto the importer, and we understand you may find this to be challenging. Tasks and functions that you’re used to BorderBuddy providing, are now going to be required to be completed by you as the importer.

The process of delegation allows you to assign access to certain functionalities within the CCP to BorderBuddy (or other third parties like customs brokers and service providers). It will allow them to manage the delegated functions on your behalf.

Note: You will need to delegate access to each Customs Broker you use if you use more than one!

BAM Or PAM? What Kind Of Delegation Do I Choose?

Delegation also consists of assigning CCP roles to your internal employees. You can have as many roles as you’d like, you can change them as needed, and if access is no longer required – you can expire them as well.

The Different Types Of Delegations Available Are:

BUSINESS ACCOUNT MANAGER (BAM):

This is the most important role that is assigned internally. Remember, it is a good idea to have a minimum of 2 BAMs.

- Automatically defaults the first individual to link their account to the business as the designated BAM.

- Highest visibility and access in the CCP

- Operates at the BN9 or enterprise level

- Manages all import/export program accounts (RMs)

- Able/responsible to set up your business account and all other relevant accounts and roles within CARM

PROGRAM ACCOUNT MANAGER (PAM):

This is the secondary-level delegation available internally.

- The PAM manages your import programs at the RM (import/export account) level

EDITOR:

- This individual’s role can perform operational activities in the program assigned.

READER:

- The individual in this role can simply view operational activities in the program assigned.

Once you’ve determined who your BAM and PAM internally will be, and delegated the appropriate access levels to your employees, you now have to think about providing external delegations (customs broker(s), consultants, etc.). They will require access to the import/export programs inside the CCP.

A decision will need to be made as to which import programs to delegate access to, and which level of access is appropriate for each service provider.

Things To Consider:

- Does BorderBuddy handle the bulk of your importing business? Or do you happen to use multiple brokers for various RM accounts?

- Do you, or your company use any consultants who may require access to your import records for one or all of your customs brokers?

- Do you have a plan in place for any changes in customs brokerage firms or other changes to delegation options?

- Do you think you may need to consolidate some of the customs brokerage business or service providers to reduce the number of firms your company would need to manage?

- Do you know what services in the portal your company will manage internally and what will be managed externally?

If so – please contact us to see how we can help!

There Are Two Levels Of Access You Can Select For Your Service Providers:

THESE LEVELS ARE:

Business Management Relationship (Optimal level for your broker!)

This would delegate access to all program accounts, including programs that may be added in the future.

Program Management Relationship

Delegates access to only selected program accounts.

(None of these levels will share any of your company’s sensitive information, like bank accounts, user profiles and any business relationships)

Once Access Is Granted, The BAM Will Need To Delegate The Authority Level:

Business Account Manager – Proxy (pBAM)

Selecting a BAM for your third-party service provider will automatically default their access level to pBAM (Proxy Business Account Manager).

A pBAM can perform operational activities such as requesting rulings, making payments, view SOAs (Statement Of Accounts), along with any past invoices and payments. BorderBuddy (or any Customs Broker) who will be applying for any rulings, making your payments of duties and taxes and any aspects of managing any financial obligations with CBSA will require this level of access.

REMINDER: A pBAM will not have any access to your sensitive information (like your bank account information) – they’re unable to see or manage your employees or business relationships.

Program Account Manager – Proxy (pPAM)

This is for the third-party program account manager. This role is for the third party to handle the management of a specific import account without any access to your sensitive information, employees or business relationships.

Be sure to confirm third-party access requests, you should only be approving access to your CCP for current providers. You have the ability to reject access requests that are not associated with your business operations.

Financial Security Changes – Do I Need To Do Anything?

YES!

Gone will be the days where the RPP (Release Prior to Payment) privilege is backed by the customs broker’s bond.

Financial security is a key area of change that is impacted by the implementation of CARM. The RPP program affords importers who have posted their own financial security (customs bond) with the CBSA to benefit from the following:

Obtain release of their goods from the CBSA before paying duties and taxes.

Defer accounting for goods.

Defer payment of any duties and taxes.

This means that importers will now be required to post their own financial security with the CBSA to maintain the RPP privilege.

Importers without posted financial security, and who are not enrolled in the RPP program, or those who do not wish to enroll in the RPP program, will be required to pay in advance on the CCP or pay a CBSA cashier at the time of clearance, in order for the release of their goods.

What Do You Mean By “Posting Financial Security?”

The posting of financial security will secure all accounts payable, including duties and taxes (GST), as well as interest, adjustments, ascertained forfeitures and any SIMA fees. The posted security will also secure any penalty fees which are also included in the calculation of the amount of security required to cover the account. With CARM R2, the requirement to post security now transfers to the importer.

Security May Be Posted In One Of Two Ways For R2:

POSTING CASH SECURITY

The amount of security posted must be equal to or greater than 100% of the importer’s highest monthly accounts payable to the CBSA within the most recent 12-month period from July 25th to July 24th. This bond can be posted to the account by making a deposit through the CCP. Posting a cash bond is not possible until the go-live date which is expected sometime in May 2024.

POSTING A CONTINUOUS SURETY BOND

The amount required for non-cash bonds must be equal to or greater than 50% of the importer’s highest monthly accounts payable to the CBSA within the most recent 12-month period from July 25th to July 24th. Those without 12 months of history will need to estimate the amount of duties and taxes.

The bond amount is also subject to a $25 000 minimum and a $10 000 000 maximum for each RM account (BN15) that is associated with the BN9 business account.

Example 1:

If you have a single BN15 account, and your highest monthly total was $40 000 CAD, then 50% would be $20 000 CAD, however, you would need to secure a bond for $25 000 CAD to respect the minimum.

Example 2:

Your legal entity (BN9) has 5 RM (BN15) accounts associated with it (RM0001, RM0002, RM0003, RM0004, RM0005) and you currently have a single bond for $125K covering the total accounts payable across all 5 RM accounts, can either post individual $25K bonds per one RM (BN15) account or post one bond for $125K and allocate coverage across all 5 RM accounts as long as the allocated coverage adequately covers each RM (BN15) account and respects the $25K minimum.

Example 3:

If your legal business (BN9) has 5 associated RM accounts and currently holds a single bond for $10M covering the total accounts payable across all 5 RM (BN15) accounts, where each individual RM account has accounts payable in excess of $10M, as of CARM R2, you can either post 5 individual $10M bonds (one bond per RM (BN15) account) OR post one bond for $50M and allocate coverage across all 5 RM accounts

Legacy security forms such as certified cheques, money orders, transferable bonds, and paper bonds will no longer be supported by the core functionalities of the CARM solution and can be accepted only on an exceptional basis when digital processing is not possible (e.g. system outage).

The CBSA cannot guarantee any standard service time for processing legacy security forms.

The current RPP program remains in effect until R2 is implemented. To support the transition from financial security being provided through the old paper-bound system to the provision of financial security electronically under the new regulations for RPP, the CBSA will be including a transition period. This will permit importers to obtain the release of their goods prior to payment for up to 180 days following the implementation of R2 as long as the importer is registered in the CCP.

Any import transactions for those without RPP Financial Security will be unsecured for those 180 days.

The CBSA has provided an RPP Transition FAQ document which can be found by clicking here.

Further Information About Financial Security:

Please note that a surety customs bond can only be shared within a specific program account. For example, if you happen to have multiple import/export RM accounts, you can use the same bond to secure all of them, however, the same bond cannot also be used to secure a Carrier RM or Customs Broker RM that also falls under the same BN9.

The CBSA does not distinguish between resident and non-resident importers (NRIs). ALL commercial importers must adhere to the new financial security calculations in order to benefit from Release Prior to Payment benefits.

Under DDP terms, the Importer of Record (IOR) whose BN had been used at the time of clearance is expected to have registered in the portal and posted security and is ultimately responsible to pay the duties and taxes regardless of which party is being billed.

How Do I Get This Financial Security?

Surety bonds must be obtained from an acceptable surety company as outlined in CBSA D-Memo D17-1-8, or by contacting your company’s licenced insurance broker.

Surety companies will also be registered on the CCP and can choose to establish an electronic connection with the CBSA if they wish. The CBSA will receive the surety bond in one of two ways:

OPTION 1:

The importer themselves will obtain a bond with a surety company directly, and CARM will receive this bond via an electronic (API) connection that is established between the CBSA and the given surety company; or

OPTION 2:

The importer obtains a bond directly from the surety company and either the importer or customs broker with delegated authority will enter the bond information directly on the portal, where the surety company will then be contacted by the CBSA to have the bond information validated.

Where Can I Find More Information?

There are various ways to gather further information relating to the CARM initiative which is created and maintained by the CARM Engagement Team.

CARM Google Hub – EVERYTHING you need to know about CARM

Frequently Asked Questions (FAQs)

Contact BorderBuddy

NOTE: All R2 information is the most current information available at the time of writing. As this is subject to change, it’s recommended you periodically check in with the CBSA or you can contact us.

Start Importing!

Ready for some help getting your shipment across the border?

You’re just a click away from getting started!

Jay Mohl, Sales & Marketing, Parksville Boathouse Parksville B.C.

Amanda Burr at BorderBuddy made our shipment seamless and her customer service was outstanding. Without question, we will work with Amanda and BorderBuddy again in the future. Thanks Amanda!

Don Mariutto

“I used BorderBuddy when were in a jam with a small tile shipment to Canada — just called them randomly after a Google search. Blair handled our case, and was in constant communication with updates, and got our shipment released within 24 hours, even though we were starting the process from scratch. Based on this experience, I can’t recommend Blair and the BorderBuddy team highly enough. Even though this was just a small shipment, they handled it like it was the most important on their agenda. We will definitely work with them again in the future – hopefully though, not on an emergency basis! THANK YOU!!”

Nathan Bird

company is always so very helpful in getting things across the border without any headaches. Tara was our agent this time around and she was prompt in answering any questions, super polite over the phone and coordinated everything for us. Highly recommend using their services.