Home » Import Cars from the U.S. into Canada

With over 15 years of expertise and tens of thousands of cars imported, BorderBuddy is unrivaled in importing vehicles into Canada. Our service is not just about importing cars; it’s about delivering an unmatched level of premium, hassle-free experience for our clients.

Learn more about importing a car into Canada from any country other than the U.S.

Uncover the benefits of importing vehicles from the U.S. into Canada:

- Is it worth importing a car into Canada?

- What are the costs?

- When do you need to work with a customs broker?

- Important considerations

- How Can Border Buddy Help?

- Frequently Asked Questions

US car prices – both new and used – are usually well below Canadian prices, so saving hundreds off the sticker price makes buying across the border an attractive proposition.

Is it worth importing a car into Canada?

The United States offers a broad selection of vehicles at prices typically lower than in Canada. When considering importing a used vehicle from the U.S., it’s important to evaluate several key factors to determine if it’s the most advantageous choice for you. Here are some key things to keep in mind:

- Current Exchange Rate: The value of the Canadian dollar against the US dollar significantly influences the cost. If the Canadian dollar is weak, what seems like a great deal might end up being more expensive than anticipated.

- Import Duties and Taxes: The expenses for bringing a vehicle across the border are not uniform. They can vary greatly depending on the vehicle’s make and model, so it’s crucial to research these costs beforehand.

- Compliance with Canadian Safety Standards: Canada has stringent safety regulations for vehicles. Ensure the car you’re considering meets these standards. If not, you may need to invest additional funds in modifications, increasing the overall cost.

What are the costs?

The timeline for receiving your imported vehicle varies based on the delivery speed you choose. Our shipping partners provide a range of options, including expedited next-day delivery for your convenience.

- Import Duty: For non-NAFTA vehicles such as Toyota, Honda, Subaru, etc., there’s a 6.1% tax.

- Goods & Services Tax (GST): This is charged at 5% of the total value of the vehicle.

- Provincial Sales Tax (PST):

- British Columbia & Manitoba is 7%

- Saskatchewan is 6%

- Quebec is 9.97%

- Note: BorderBuddy only collects the 5% GST, the relative PST is collected once in Canada during the registration and insurance process.

- Air Conditioning Tax: A $100 fee is charged for vehicles equipped with air conditioning.

- Excess Weight Tax: Vehicles weighing over 2,000 kilograms (4,425 pounds) incur additional taxes.

- Gas Guzzler Tax: Vehicles with a weighted average fuel consumption rating of 13 or more litres per 100 kilometres may be subject to extra fees ranging from $1,000 to $4,000.

- BorderBuddy fees for customs clearance and Internal Transaction Number (ITN) filing.

- For an immediate estimate of the cost to import a car to Canada, please use our Free Quote Calculator

When do you need to work with a customs broker?

You can self-import and self-declare a vehicle into Canada without a customs broker under these circumstances:

- Personal Import: If you’re importing the vehicle for personal use, rather than commercial purposes.

- Familiarity with Process: If you’re comfortable with and understand the importation process, including completing required paperwork and paying applicable duties and taxes.

- Compliance with Regulations: You must ensure the vehicle meets all Canadian safety and environmental standards.

- Documentation: Have all necessary documents ready, such as proof of ownership, export documents from the originating country, and a bill of sale.

- CBSA Requirements: Be prepared to meet all requirements set by the Canada Border Services Agency (CBSA), including inspections and payment of fees.

- No Legal Complexities: If the import doesn’t involve complex legal situations like liens or inheritances.

While a customs broker can simplify the process, especially for first-time importers or complex cases, self-importing is feasible if you are well-prepared and knowledgeable about the process.

Tax exemption eligibility: Individuals may be eligible for tax exemption up to $10,000 when moving to Canada as a new settler or when returning to Canada after an extended stay in the U.S.

Contact the Canada Border Services Agency (CBSA) at 1-800-461-9999 to verify your eligibility. If you meet the eligibility criteria, you will be required to self-declare your vehicle at the Canadian border

Important Considerations When Importing Cars

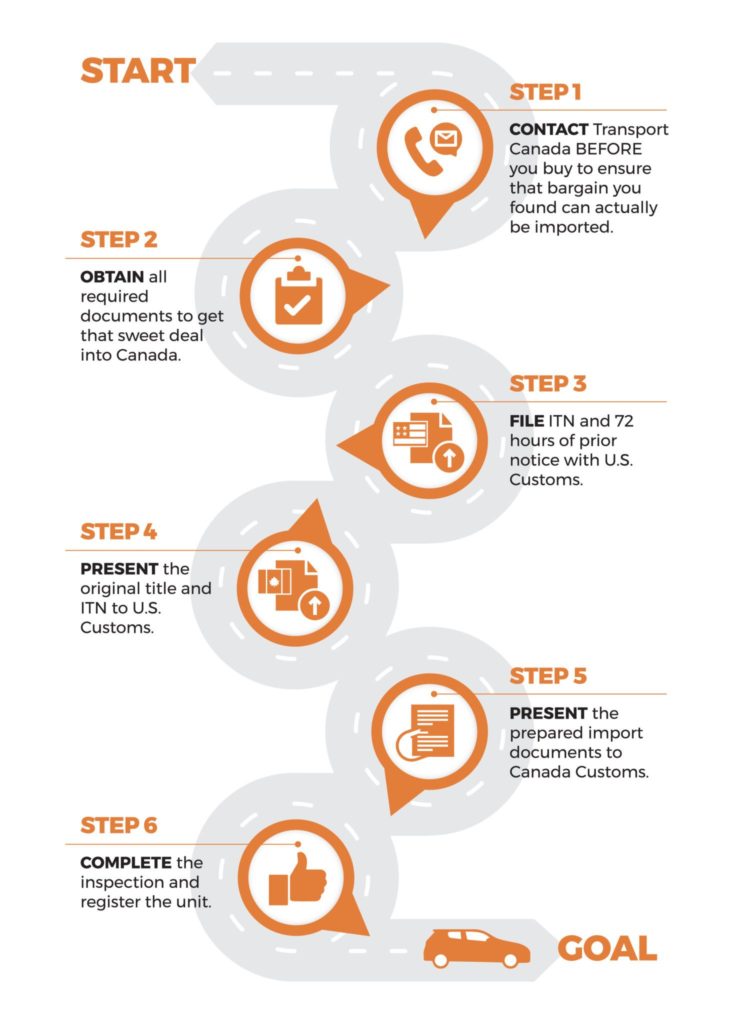

Regardless of the new government restrictions, this is a breakdown of steps you need to take to make when importing a car to Canada a seamless process:

1. Satisfy All Government Agencies

It’s important to check and satisfy all government border agencies when importing a vehicle into Canada, including:

- Transport Canada

- Canada Border Services Agency

- Canadian Food Inspection Agency

- Environment and Climate Change Canada

- U.S. Customs and Border Protection

2. Ensure Your Vehicle is Admissible

Transport Canada has a list of vehicles that are admissible to be imported. Before buying a vehicle in the U.S., you must make sure it’s on this list. The list covers a vast array of elements, such as vehicle age, electronic immobilization systems, running lamps, or if there are any recall notices outstanding. Recalls can be especially tricky and Transport Canada requires that importers contact vehicle manufacturers directly on the latest notices.

3. Have the Right Documentation

Bureaucrats are sticklers for paperwork so you have to make sure all your documentation is in order. It’s not enough to just have a bill of sale; your vehicle must come with documents detailing:

- Title

- A recall clearance letter

- Export certificates

- A manufacturer’s statement of compliance

4. Pass Inspection

Any vehicle imported into Canada must be able to comply with our nation’s strict safety standards. During the import process, the vehicle must pass a Registrar of Imported Vehicles (RIV) inspection. The RIV is a division of Transport Canada and makes sure vehicles meet Canada’s motor vehicle standards. One key factor with any vehicle passing the inspection is determining if it has been “modified” in any way. Once modified (not including routine maintenance or general repairs), the vehicle no longer maintains its original factory-issued certification. Which RIV needs to know if you have modified the vehicle to make sure it still meets Transport Canada requirements.

5. Pay The RIV Registration Fee

As with any bureaucratic requirement, paying the fee requires several steps. There is also a list of exemptions and you’ll need to determine if your vehicle is on that list.

How can BorderBuddy Help you get a Vehicle into Canada?

Step 1- Contact Transport Canada:

Avoid the disappointment of investing in a vehicle that fails to meet Canada’s rigorous safety regulations. Before proceeding, gather all the vehicle specifications and directly contact Transport Canada at 1-800-333-0371 to ensure compliance. It’s better to be safe than sorry!

Step 2 – Obtain Necessary Documents:

Collaborate closely with the seller as they are required to sign the original title and provide a recall clearance letter along with a bill of sale. Be aware, any unresolved recalls on the vehicle might complicate or even halt your import plans.

*Step 3 – File for ITN:

The Internal Transaction Number (ITN) is a crucial part of the export/import process. Make sure this number is included in your application to initiate the mandatory 72-hour export notification period.

Step 4 – Present Documents at U.S. Customs:

Timing is crucial in this step. With BorderBuddy’s guidance, you’ll know exactly when to cross the border. At this juncture, you need to present the original title and all documents prepared by BorderBuddy in person to U.S. Customs.

Step 5 – Present Documents at Canadian Customs:

After clearing U.S. Customs, your next step is to present your import documents to Canadian Customs. Stay focused – you’re nearing the completion of your import process.

Step 6 – Complete the Import Process:

Remember, Canadian automotive standards are more stringent than those in the U.S. Passing a vehicle inspection is essential, and this can be conducted by any licensed mechanic. This final step ensures your vehicle is road-ready according to Canadian standards.

How Can BorderBuddy Assist You in Vehicle Import?

Our experience and expertise make importing a vehicle into Canada a seamless, premium experience. Trust us to handle every detail, ensuring your import meets all regulations and standards. Start your journey with BorderBuddy today and experience the ease of premium vehicle import services.

Exploring? Get a free quote by visiting our online import quote calculator.

Ready to import? Call us at 1.866.441.2161 or email us at [email protected] to get started!

Frequently asked questions:

Q: How do I make sure my vehicle complies with all Government Agencies?

Ensure compliance with all relevant Canadian and U.S. government agencies during the import process. This includes: Transport Canada / the Registrar of Imported Vehicles (RIV), Canada Border Services Agency, Canadian Food Inspection Agency, Environment and Climate Change Canada, and U.S. Customs and Border Protection.

Transport Canada / RIV maintains a list of vehicles eligible for import. Prior to purchasing a vehicle in the U.S., confirm that it is on this list. The criteria include various factors like vehicle age, electronic immobilization systems, daytime running lamps, and outstanding recall notices. It’s essential to contact vehicle manufacturers directly for the latest recall information as per Transport Canada’s requirements.

Imported vehicles must meet Canada’s rigorous safety standards. They are subject to inspection by the Registrar of Imported Vehicles (RIV), a division of Transport Canada. It’s important to note whether the vehicle has been modified in any way, as modifications (excluding routine maintenance or general repairs) can affect the vehicle’s compliance with original factory standards, which RIV will evaluate.

Q: What is the Registrar of Imported Vehicles (RIV)?

The Registrar of Imported Vehicles (RIV) is an agency responsible for ensuring that all vehicles imported into Canada meet the country’s safety and environmental standards. It operates under the authority of Transport Canada], and it plays a critical role in the importation process. When a vehicle is imported, RIV oversees the inspection and modification processes to ensure compliance with national standards. This includes managing paperwork, coordinating inspections, and providing guidance to importers on necessary modifications and steps. The RIV ensures that all imported vehicles are safe and legal to drive on national roads, protecting both the vehicle owners and other road users.

The process of paying the RIV registration fee involves several steps. Be sure to check if your vehicle qualifies for any exemptions on the fee.

Q: Does the age of my vehicle matter?

Yes! The year of your car being imported from the states does matter. Federal inspection is required on vehicles less than 15 years old, in order to ensure that the car meets Canada’s safety and legal requirement. For more information, see Transportation Canada and Registrar of Imported Vehicles.

Q: What documentation will I require?

Proper documentation is critical. This goes beyond having a bill of sale. Required documents include:

- Bill of Sale

- Vehicle Title

- A recall clearance letter

- A manufacturer’s statement of compliance

- See examples here

Q: Can I import a into Canada Vehicle Temporarily?

Yes! Visitors, tourists and temporary residents can import vehicles temporarily into Canada, as well as Canadians who rented a US vehicle and brought it across the border. Vehicles that don’t satisfy Canada’s safety measures can be temporarily imported by completing a special import Declaration. Vehicles that are imported temporarily are also exempt from needing RIV registration, so long as it’s used by temporary residents, diplomats or Canadian or US armed forces.

Q: Can I sell a foreign Vehicle in Canada?

Yes! Once you’ve imported a vehicle into Canada, and have gone through all the required proceedings, then you’re free to do as you wish with the vehicle – including selling it.

It is important to note that a foreign vehicle cannot be sold or gifted on Canadian soil unless it has been properly imported first.

Looking to start a car importing and selling business? BorderBuddy can help, contact our sales team to find out more about becoming a partner!

Q: Can I import my personal vehicle that is already in Canada?

There is only one port in Canada that permits vehicles to remain in Canada during the import/export process. All other ports of entry require the vehicle to be taken back to the United States for exporting/ importing purposes.

Q: A vehicle was gifted to me, is it subject to tax?

Duty (if applicable) and 5% GST is applicable for gifted vehicles,

Provincial Sales Tax (PST) will be exempted once the vehicle is registered and insured in Canada a gift letter will be required

Value for taxes is based on the fair market value of the vehicle, The fair market value can be found on KBB

Q: Can someone other than the purchaser of the vehicle drive it through customs?

Yes! If it is a designated and licensed transportation company.

No! If it is not a licensed transportation company. No a friend or family member cannot drive the car across the border on behalf of the purchaser.

Q: I haven’t paid for the vehicle yet. I still need to see it and finalize the purchase. So the seller won’t sign the Title until I pay for it. If all goes well, does that mean I have to wait in the U.S. for 4 days until I can cross back into Canada with the vehicle?

This is a common situation for many buyers importing vehicles from the U.S. to Canada. The process typically involves these steps:

- Finalizing the Purchase: When you go to see the vehicle, and if you decide to proceed with the purchase, complete the payment. Only after payment will the seller sign over the Title to you.

- Obtaining the Title: Once the Title is signed over to you, you will have legal ownership of the vehicle.

- Crossing the Border: Regarding the waiting period, it’s important to understand that U.S. Customs and Border Protection requires that you submit the vehicle export documents at least 72 hours (3 days) prior to export. This does not necessarily mean you have to stay in the U.S. during this waiting period. However, the vehicle cannot leave the U.S. until this requirement is met.

- Planning Your Return: You can return to Canada and then come back to the U.S. to drive the vehicle across the border once the 72-hour period has passed and the export process is clear. Alternatively, you can plan your activities in the U.S. during this waiting period.

It’s always advisable to plan your trip and vehicle pickup considering this 72-hour export requirement to avoid any last-minute complications.

Q: I am in Canada, how do I pay for the vehicle that I bought in the US if I can’t bring more than $10,000 in cash with me into the U.S.?

When purchasing a vehicle in the U.S. as a Canadian resident, it’s important to understand the restrictions on carrying cash across borders. You’re correct that there is a limit to the amount of cash you can bring into the U.S. without declaring it; the limit is $10,000 USD. To comply with this and still complete your vehicle purchase, consider the following payment options:

- Bank Transfer: You can arrange a direct bank transfer from your Canadian bank to the seller’s bank in the U.S. This is often the safest and most efficient way to transfer large sums of money internationally.

- Cashier’s Check or Bank Draft: These are secure forms of payment that can be obtained from your bank. You carry the check with you, which is made payable to the seller. This method is often preferred by sellers as it is guaranteed by the bank.

- Money Order: Similar to a cashier’s check, a money order can be purchased in Canada and then mailed or hand-delivered to the seller.

- Electronic Payment Services: Services like PayPal or other international payment platforms can be used for transactions. However, be aware of transaction limits and fees.

- Credit Card Payment: If the seller agrees, you can pay with a credit card. This might involve transaction fees and would depend on your credit limit.

Before selecting a payment method, discuss with the seller what they prefer or are willing to accept. Additionally, always ensure that any payment method used provides sufficient documentation for the purchase, as this will be important for vehicle importation and registration processes.

Q: I just wanted to get a quote to import a vehicle. What do you guys charge and what fees would I have to pay to import it?

Exploring? Get a free quote by visiting our online import quote calculator.

Ready to import? Call us at 1.866.441.2161 or email us at [email protected] to get started!

Q: I’m moving to Canada/back to Canada and want to import my vehicle which I bought a few years ago. Do you need the original bill of sale?

When moving to Canada or returning to Canada and importing a vehicle you’ve owned for several years, the requirement for the original bill of sale can vary. Here are the key points to consider:

- Proof of Ownership: The most critical document is proof of ownership, which is typically the vehicle title or registration documents. These documents should clearly indicate your name as the owner.

- Original Bill of Sale: While the original bill of sale is useful, especially for vehicles purchased recently, it may not be strictly necessary for a vehicle bought 6 years ago. However, if available, it’s beneficial to have it as it provides a history of the vehicle’s purchase and can help in determining duties or taxes, if applicable.

- Other Documentation: You may also need to provide other documentation such as your driver’s license, proof of insurance, and any export/import forms required by Canadian customs.

- Vehicle Compliance: Ensure your vehicle meets Canada’s safety and environmental standards. For vehicles older than 15 years, there may be different requirements or exemptions.

- Consult with RIV: It’s advisable to consult with the Registrar of Imported Vehicles (RIV) or a similar authority in Canada for specific guidance based on your vehicle and circumstances. They can provide up-to-date information about documentation requirements and the import process.

- Personal Importation: Since you are moving or returning to Canada and have owned the vehicle for a significant period, this may classify as personal importation, which might have different rules compared to commercial importation.

Remember, regulations can change, so it’s always best to verify the latest requirements with the appropriate Canadian authorities.

Q: What if the seller does not have the Certificate of Title?

If the seller of a vehicle does not have the Certificate of Title, it’s important to proceed with caution, as the title is a critical document proving ownership of the vehicle. Here are steps you can take in this situation:

- Verify the Reason: Ask the seller why they don’t have the title. Sometimes, it might be lost or misplaced. In other cases, the vehicle could still be financed, and the lender holds the title.

- Apply for a Duplicate Title: If the title is lost or damaged, the seller should apply for a duplicate title through their state’s Department of Motor Vehicles (DMV) or equivalent agency. This process varies by state, but generally requires filling out an application, paying a fee, and providing proof of ownership.

- Lien Release: If there is a lien on the vehicle because it’s financed, ensure the seller obtains a lien release from the lender. This document is needed to transfer ownership and get a new title.

- Avoid Cash Transactions: Until the title issue is resolved, it’s advisable not to exchange any significant amount of money. A deposit might be reasonable, but full payment should be contingent on receiving a valid title.

- Written Agreement: If you agree to purchase the vehicle under these circumstances, make sure to have a written agreement outlining the terms, including the seller’s commitment to provide the title by a specific date.

- Legal Advice: Consider seeking legal advice. The process of buying a vehicle without a title can be complicated and risky.

- Check for Theft: Without a title, there’s a risk the vehicle could be stolen. You can check the Vehicle Identification Number (VIN) through various services to ensure the vehicle isn’t reported as stolen.

- Consider Alternatives: If the process of obtaining a new title seems too complex or risky, it might be prudent to consider other vehicle options.

Remember, the title is a key document in proving vehicle ownership and legality. Proceeding without it can lead to complications in ownership, registration, and legality of the vehicle.

Q: It’s a private sale so does the seller just write me an Invoice?

In the case of a private vehicle sale, an invoice or bill of sale is indeed a crucial document. Here’s what you should know about it:

- Purpose of the Invoice/Bill of Sale: This document serves as a formal record of the transaction. It provides proof of purchase and can be used for registration and taxation purposes.

- Content of the Invoice/Bill of Sale: The invoice should include the following details:

- Date of Sale: The exact date when the sale is finalized.

- Seller’s Information: Full name, address, and contact details of the seller.

- Buyer’s Information: Your full name, address, and contact details.

- Vehicle Details: Make, model, year, color, Vehicle Identification Number (VIN), and current mileage.

- Sale Price: The agreed-upon amount for the vehicle.

- Payment Terms: Specifies how and when the payment is made (e.g., in full, deposit followed by balance).

- As-Is Clause: Most private sales are “as-is,” meaning no warranties are given, and the buyer accepts the vehicle in its current condition.

- Signatures: Both the buyer and the seller should sign and date the invoice.

- Legal Requirement: While an invoice is not always legally required, it’s strongly recommended as it protects both parties in case of disputes or for tax purposes.

- Notarization: Depending on your jurisdiction, you might also need to have the invoice notarized.

- Additional Documents: Ensure you also receive the vehicle title (signed over to you) and any other relevant documents such as service records.

- Consult Local Regulations: It’s advisable to consult local regulations or a legal advisor to ensure that all necessary information is included and that the sale is compliant with local laws.

Q: Does the title need to be transferred before it can be exported?

Yes, the title of the vehicle generally needs to be transferred to the exporter’s name before it can be legally exported from the United States. Here are the key points you should know:

- Proof of Ownership: The title is the primary document proving ownership of the vehicle. U.S. Customs and Border Protection (CBP) requires proof that the person exporting the vehicle is its rightful owner.

- Clear and Valid Title: The title must be clear (i.e., no liens or encumbrances) and valid. If there is a lienholder, their consent or a lien release may be required.

- Export Documentation: Along with the title, you may need to provide other export documentation. This could include a bill of sale, a foreign buyer’s identification, and export forms.

- Title Transfer Process: To transfer the title, the seller must complete the transfer section on the back of the title document, including the buyer’s name, date of sale, odometer reading, and price. The buyer then submits this to their state’s Department of Motor Vehicles (DMV) or equivalent agency to complete the transfer. Click here to learn more

- 72-Hour Rule: U.S. Customs requires that you submit the vehicle export documents at least 72 hours before export. This includes the title or a certified copy of the title.

- Consult Authorities: Always check the latest requirements with U.S. Customs and Border Protection and the DMV in the state where the vehicle is titled, as rules can vary by state and over time.

Transferring the title before exportation is a crucial step in the legal export of a vehicle from the U.S., ensuring compliance with both export and import regulations.

Q: How do I get a in-transit license / tag and insurance to drive it back to Canada? What do I use for license plates?

Driving a vehicle from the U.S. to Canada requires an in-transit license or tag and appropriate insurance. Here’s how to manage this:

- In-Transit License/Tag:

- Application: In most U.S. states, you can apply for an in-transit permit at the local Department of Motor Vehicles (DMV) or equivalent agency.

- Documentation Needed: Typically, you’ll need proof of insurance, the bill of sale, and identification. Some states may also require proof of ownership or a title transfer.

- Duration and Validity: These permits are usually valid for a short period, such as 30 days, allowing you enough time to transport the vehicle to Canada.

- Insurance:

- U.S. Insurance: You’ll need to obtain temporary insurance coverage from a U.S. insurance company for the duration of your trip.

- Canadian Insurance: It’s also advisable to contact your Canadian insurance provider to arrange for coverage that begins once you cross the border.

- License Plates:

- Temporary Plates: The in-transit permit often comes with temporary license plates that you affix to the vehicle for your journey.

- Using Plates from Another Vehicle: Avoid using license plates from another vehicle, as this can lead to legal issues.

- Compliance with Laws: Ensure that the vehicle complies with both U.S. and Canadian road laws, including any equipment or safety standards.

- Customs and Border Requirements: Be aware of any requirements or paperwork needed for customs when you cross the border into Canada.

- Plan Your Route: Plan your journey, considering the validity period of the in-transit permit and temporary insurance.

Securing an in-transit license or tag and appropriate insurance coverage is crucial for legally and safely driving a vehicle from the U.S. to Canada. Always check the latest requirements from the relevant DMV and insurance providers.

Q: After you file the export papers and the 72 hours have passed, is there a time limit or due date to get the car out?

Once the export papers have been filed and the mandatory 72-hour waiting period has elapsed, the following guidelines typically apply:

- Export Window: Generally, after the 72-hour period, there is a window of time within which you should export the vehicle. This period can vary but is often within a few weeks or a month. It’s crucial to check the specific timeframe with the U.S. Customs and Border Protection (CBP) or the relevant export authority.

- Validity of Export Approval: The approval for export given by U.S. Customs is valid for a limited time. It’s important to confirm how long the approval remains valid to avoid any complications.

- Potential for Extensions: If circumstances prevent you from exporting the vehicle within the specified timeframe, contact the export authority or U.S. Customs office where you filed the paperwork. They may provide guidance on extensions or additional steps you need to take.

- Re-Submission of Export Papers: If you are unable to export the vehicle within the validity period of the export approval, you may need to re-submit the export papers and undergo another 72-hour waiting period.

- Check Latest Regulations: Export regulations can change, so it’s advisable to verify the current rules and timeframes with the appropriate authorities.

It’s important to plan your export in accordance with these timeframes to ensure a smooth process and to avoid any legal issues.

Q: It’s my understanding that once the export request has been made, the car needs to remain in the US for 72 hours, is that a min of 72 hours or an ‘up to 72 hours’?

The 72-hour rule for exporting a vehicle from the U.S. specifically refers to a minimum requirement. Here’s what this means:

- Minimum Timeframe: Once you have submitted the export request along with all the necessary documentation to U.S. Customs and Border Protection (CBP), the vehicle must remain in the U.S. for at least 72 hours. This period is a mandatory waiting time for CBP to process the export paperwork and conduct any necessary checks.

- Not an ‘Up To’ Period: The rule is not an ‘up to 72 hours’ timeframe where the vehicle can be exported sooner if the paperwork is processed early. The vehicle cannot be legally exported until the full 72 hours have passed.

- After 72 Hours: Once the 72-hour period is complete, and provided that there are no issues with your paperwork or other legal impediments, you are free to export the vehicle.

- Timing of Export: It’s advisable to plan your export immediately after the 72-hour period to ensure compliance with the regulations and to facilitate a smooth transition across the border.

- Check with CBP: Always confirm with the local CBP office handling your export to ensure that all requirements have been met and that you have the most current information.

This rule is in place to allow U.S. Customs the necessary time to perform any checks and avoid illegal exports. Compliance with this regulation is crucial for a lawful and hassle-free vehicle export process.

Q: How do I make the payment to BorderBuddy and when does it need to be paid?

BorderBuddy accepts payments through various methods

- Credit Card

- Paypal

- E-Transfer

- Wire

- Bill Payment

Once your paperwork is processed by BorderBuddy, you will receive an invoice with payment instructions via your preferred method. You can expect to receive the invoice at least three days before your scheduled crossing date. Payment must be made prior to importing or exporting your vehicle.

Start Importing!

Ready for some help getting your shipment across the border?

You’re just a click away from getting started!

Jay Mohl, Sales & Marketing, Parksville Boathouse Parksville B.C.

Amanda Burr at BorderBuddy made our shipment seamless and her customer service was outstanding. Without question, we will work with Amanda and BorderBuddy again in the future. Thanks Amanda!

Don Mariutto

“I used BorderBuddy when were in a jam with a small tile shipment to Canada — just called them randomly after a Google search. Blair handled our case, and was in constant communication with updates, and got our shipment released within 24 hours, even though we were starting the process from scratch. Based on this experience, I can’t recommend Blair and the BorderBuddy team highly enough. Even though this was just a small shipment, they handled it like it was the most important on their agenda. We will definitely work with them again in the future – hopefully though, not on an emergency basis! THANK YOU!!”

Nathan Bird

company is always so very helpful in getting things across the border without any headaches. Tara was our agent this time around and she was prompt in answering any questions, super polite over the phone and coordinated everything for us. Highly recommend using their services.